Investor sentiment, driven by emotions and perceptions, plays a significant role in shaping stock market movements. In this comprehensive article, we delve into the fascinating world of investor sentiment and its profound influence on the stock market. From understanding the basics of investor sentiment to exploring its impact on market trends, volatility, and investor behavior, we unravel the intricate relationship between investor sentiment and the stock market. By grasping the dynamics of investor sentiment, investors can gain valuable insights to make informed decisions and navigate the ever-changing landscape of the stock market.

Understanding Investor Sentiment

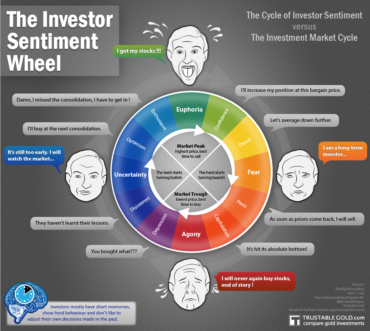

Investor sentiment refers to the overall attitude, emotions, and perceptions of market participants towards the stock market and specific investments. It can range from extreme optimism to extreme pessimism, influencing investor behavior and driving market movements. Key aspects of understanding investor sentiment include:

- Behavioral Finance: Investor sentiment is closely linked to behavioral finance, a field of study that explores how psychological biases affect financial decisions. Emotional biases, such as fear, greed, and herd mentality, can significantly impact investor sentiment.

- Market Psychology: Investor sentiment is driven by psychological factors, including perception of risk, market expectations, and cognitive biases. These psychological factors can lead to irrational market behavior and influence stock prices.

Impact of Investor Sentiment on the Stock Market

Investor sentiment has a profound impact on stock market dynamics, influencing market trends, volatility, and investment outcomes. Here are some key areas where investor sentiment exerts its influence:

- Market Trends: Investor sentiment often drives the formation of market trends. During periods of optimism, positive sentiment can fuel buying activity, leading to bullish trends. Conversely, during periods of pessimism, negative sentiment can trigger selling pressure and contribute to bearish trends.

- Volatility: Investor sentiment plays a crucial role in market volatility. Heightened levels of investor fear or uncertainty can lead to increased market volatility, resulting in rapid price swings and heightened trading activity.

- Market Bubbles and Crashes: Investor sentiment can contribute to the formation of market bubbles, characterized by inflated asset prices driven by excessive optimism. Likewise, sharp declines or market crashes can occur when investor sentiment abruptly shifts from optimism to pessimism.

- Investor Behavior: Investor sentiment influences individual investor behavior. During periods of optimism, investors may exhibit higher risk tolerance, leading to increased buying and potentially overvalued markets. Conversely, during periods of pessimism, investors may become risk-averse and engage in selling, potentially undervaluing certain stocks.

Strategies for Navigating Investor Sentiment

Understanding and effectively navigating investor sentiment is crucial for investors seeking to make informed decisions. Consider the following strategies:

- Contrarian Approach: Adopting a contrarian approach involves going against the prevailing sentiment. Buying when sentiment is excessively negative or selling during periods of extreme optimism can allow investors to capitalize on potential market inefficiencies.

- Fundamental Analysis: Conduct thorough fundamental analysis to evaluate the underlying value of stocks. By focusing on company fundamentals, investors can make informed decisions based on the intrinsic value of the business rather than being swayed solely by sentiment-driven market movements.

- Diversification: Maintain a well-diversified portfolio across different asset classes, sectors, and regions. Diversification helps mitigate the impact of negative sentiment on specific stocks or sectors, ensuring a balanced approach to investing.

- Long-Term Perspective: Adopting a long-term investment perspective can help ride out short-term fluctuations caused by investor sentiment. By focusing on the underlying fundamentals and long-term growth prospects, investors can avoid reactionary decision-making based on short-term sentiment swings.

Investor sentiment holds tremendous power in influencing stock market dynamics. Understanding the intricacies of investor sentiment can provide valuable insights for investors navigating the stock market. By recognizing its impact on market trends, volatility, and investor behavior, investors can make more informed decisions and potentially capitalize on market inefficiencies. Stay attuned to investor sentiment, adopt a rational approach, and leverage the power of understanding investor sentiment to enhance your investment strategies in the dynamic world of stocks.

The Power of Investor Sentiment: Influencing the Stock Market Dynamics