The stock market is a dynamic environment that constantly presents opportunities for investors and traders. One valuable tool for identifying potential price reversals and trend changes is the analysis of divergences. Divergences can provide insights into the underlying strength or weakness of a stock or an entire market. In this article, we will explore what divergences are, why they occur, how to identify them, and how to effectively incorporate divergence analysis into your trading strategy.

Table of contents

What Are Divergences?

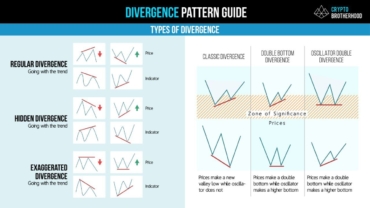

Divergences, in the context of the stock market, refer to a situation where the price of a security moves in a different direction than a related technical indicator. This discrepancy between price and indicator signals a potential shift in the prevailing trend. Divergences can be classified into two types: bullish divergences and bearish divergences.

A bullish divergence occurs when the price of a stock makes a lower low, while the corresponding indicator makes a higher low. This indicates that despite the price declining, the underlying momentum is starting to strengthen, suggesting a potential reversal to the upside.

Conversely, a bearish divergence happens when the price of a stock makes a higher high, while the indicator makes a lower high. This implies that although the price is rising, the underlying momentum is weakening, indicating a possible trend reversal to the downside.

Why Do Divergences Occur?

Divergences occur due to various factors influencing the stock market. Supply and demand dynamics play a significant role, where buying or selling pressure may not align with the current price action. Investor sentiment also affects divergences, as fear or greed can lead to irrational buying or selling decisions. Additionally, market manipulation by institutional investors or market makers can create false divergences to deceive retail traders.

How to Identify Divergences

To identify divergences, traders often rely on technical indicators and chart patterns. Popular technical indicators for this analysis include the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Stochastic Oscillator. These indicators measure price momentum and overbought or oversold conditions, providing signals when they occur.

Chart patterns, such as double tops and double bottoms, or head and shoulders patterns, can also indicate the presence of divergences. These patterns form when the price reaches a significant high or low, accompanied by a divergence in the corresponding indicator.

Interpreting Bullish Divergences

A bullish divergence suggests that despite the downtrend in price, the underlying momentum is shifting to the upside. It indicates a potential buying opportunity as the market sentiment begins to favor the bulls. Traders often use bullish divergences to confirm the end of a downtrend and anticipate a trend reversal. However, it is important to wait for additional confirmation before taking action.

Scenario

ABC Corporation’s stock has experienced a prolonged downtrend over the past few months. Investors and traders who solely rely on the price action might perceive the stock as weak and avoid entering long positions. However, by incorporating divergence analysis, we can uncover potential bullish opportunities.

Divergence Analysis: Using the Moving Average Convergence Divergence (MACD), a widely used indicator for divergence analysis, we identify a bullish divergence in ABC Corporation’s stock. Despite the ongoing downtrend, the MACD histogram starts to show higher lows, indicating a potential shift in momentum.

This bullish divergence suggests that even though the stock’s price continues to decline, the underlying momentum is starting to strengthen. It serves as a signal that the downtrend may be losing steam, and a potential reversal to the upside could be on the horizon.

Trading Decision: Armed with the knowledge of the bullish divergence, traders can approach the situation with a more optimistic outlook. Rather than avoiding the stock, they may consider initiating long positions or accumulating shares, anticipating a potential trend reversal.

It is important to wait for additional confirmation before executing trades based solely on the bullish divergence. Traders might look for other technical indicators, such as bullish chart patterns or increased buying volume, to validate the potential reversal.

Outcome: Following the identification of the bullish divergence, ABC Corporation’s stock begins to show signs of a trend reversal. The price starts to climb, confirming the validity of the divergence analysis. Traders who recognized the bullish divergence and entered long positions could capitalize on the subsequent upward movement, potentially generating significant profits.

Key Takeaways: This case study demonstrates the importance of interpreting bullish divergences in the stock market. By combining price analysis with technical indicators like the MACD, traders can identify potential opportunities even in the midst of a downtrend.

Interpreting Bearish Divergences

A bearish divergence signals that even though the price is rising, the underlying momentum is weakening, potentially indicating a reversal to the downside. It serves as a warning sign for traders who may consider taking profits or establishing short positions. Like bullish divergences, bearish ones require confirmation from other technical indicators or patterns before making trading decisions.

Scenario

XYZ Inc.’s stock has been experiencing a sustained uptrend over the past few months, reaching new highs. Traders who solely rely on the price action might assume that the stock will continue its upward trajectory. However, by incorporating divergence analysis, we can gain insights into potential downside risks.

Divergence Analysis: Using the Relative Strength Index (RSI), a popular indicator for this analysis, we identify a bearish divergence in XYZ Inc.’s stock. Despite the ongoing uptrend, the RSI starts to exhibit lower highs, indicating a potential shift in momentum.

This bearish divergence suggests that although the stock’s price continues to rise, the underlying momentum is weakening. It serves as a cautionary signal that the uptrend may be losing steam, and a potential reversal to the downside could be on the horizon.

Trading Decision: Armed with the knowledge of the bearish divergence, traders can approach the situation with increased vigilance. Rather than assuming the uptrend will persist, they may consider taking profits or establishing short positions, anticipating a potential trend reversal.

It is crucial to wait for additional confirmation before executing trades solely based on the bearish divergence. Traders might look for other technical indicators, such as bearish chart patterns or increased selling volume, to validate the potential reversal.

Outcome: Following the identification of the bearish divergence, XYZ Inc.’s stock begins to exhibit signs of a trend reversal. The price starts to decline, confirming the validity of the this analysis. Traders who recognized the bearish divergence and took appropriate actions could capitalize on the subsequent downward movement, potentially preserving their profits or even generating gains from short positions.

Key Takeaways: This case study underscores the importance of interpreting bearish divergences in the stock market. By combining price analysis with technical indicators like the RSI, traders can identify potential risks even during an uptrend.

Trading Strategies

Divergences can be used as a confirmation tool in conjunction with other technical analysis techniques. Traders often combine these signals with support and resistance levels, trendlines, or candlestick patterns to increase the probability of successful trades. Additionally, setting appropriate stop-loss and take-profit levels helps manage risk and maximize potential profits.

Limitations

While this type of analysis can be a powerful tool, it is not without limitations. False signals and whipsaws can occur, leading to losses if traders solely rely on them. Market conditions, such as low liquidity or high volatility, can also impact the accuracy of divergence signals. Therefore, it is crucial to practice risk management and utilize other technical analysis tools to validate these signals.

Case Studies: Divergence Analysis in Action

Examining real-world examples can provide valuable insights into the effectiveness of divergence analysis. By studying successful divergence trades in the past, traders can gain a deeper understanding of the patterns and indicators that yielded profitable outcomes. Learning from case studies also helps refine divergence strategies and avoid common pitfalls.

Scenario

XYZ Company’s stock has been on an upward trend for several months, consistently making higher highs and higher lows. Traders who solely rely on the price action might assume that the stock is poised to continue its upward trajectory. However, by incorporating divergence analysis, we can gain a deeper understanding of the stock’s potential trend reversal.

Divergence Analysis: Using the Relative Strength Index (RSI), a popular indicator for divergence analysis, we observe that the RSI has been showing a different pattern than the stock price. While the stock has been making higher highs, the RSI has been forming lower highs, indicating a bearish divergence.

This bearish divergence suggests that the underlying momentum of XYZ Company’s stock is weakening, despite the price reaching new highs. It serves as a warning sign that the stock’s upward trend might be losing steam and could potentially reverse in the near future.

Trading Decision: Armed with this divergence analysis, traders can approach the situation with caution. Instead of blindly assuming the uptrend will continue, they may consider taking profits or establishing short positions to capitalize on the potential reversal. It is important to wait for additional confirmation before executing any trades.

Outcome: Shortly after the bearish divergence is identified, XYZ Company’s stock starts to exhibit signs of a reversal. The price begins to decline, validating the this analysis and providing an opportunity for traders to profit from the downside movement. Those who incorporated this type of analysis into their trading strategy were able to navigate the market with more clarity and make informed decisions.

Key Takeaways: This case study illustrates the power of this analysis in providing early warnings of potential trend reversals. By combining price action with technical indicators like the RSI, traders can gain insights into the underlying momentum and make more informed trading decisions.

Tips for Effective Divergence Analysis

To enhance the effectiveness, traders should exercise patience and discipline. It is important to wait for clear distinct signals rather than jumping into trades prematurely. Additionally, analyzing multiple timeframes can provide a broader perspective on divergences and improve the accuracy of trading decisions. Backtesting these strategies using historical data is another valuable practice to refine trading techniques.

The Psychological Aspect

Successful divergence trading requires managing emotions and building confidence in distinct signals. Traders must remain calm and disciplined, avoiding impulsive decisions based on fear or greed. Developing mental fortitude and maintaining a long-term perspective are crucial for navigating the ups and downs of the market.

Divergences in Different Market Conditions

Divergence analysis can be applied to different market conditions, including trending and range-bound markets. Traders should adapt their distinction strategies accordingly. In trending markets, divergences can indicate potential trend reversals or continuation patterns. In range-bound markets, divergences can help identify price extremes and potential breakout or breakdown opportunities.

The Role of Fundamental Analysis.

While distinction analysis primarily focuses on technical indicators, incorporating fundamental analysis can provide a more comprehensive view of market dynamics. Understanding the interplay between technical and fundamentals helps traders make more informed decisions and increases the accuracy of these signals.

Divergences are valuable tools in the stock market for identifying potential trend reversals and price shifts. By understanding the different types, how to identify them using technical indicators and chart patterns, and the appropriate trading strategies, traders can increase their chances of success. However, it is essential to be aware of the limitations and practice risk management when incorporating this analysis into trading strategies.

Frequently Asked Questions (FAQs)

- Can they be used for short-term trading?

- Yes, they can be effective for short-term trading as they provide insights into potential trend reversals and price movements.

- Are they more effective in certain sectors or industries?

- They can be applied to any sector or industry as they are based on price and indicator relationships, which are universal concepts in technical analysis.

- How often do theyoccur in the stock market?

- They occur regularly in the stock market as they are a natural result of market dynamics and fluctuations in supply and demand.

- Can this indicator be used to analyze other financial markets?

- Yes, this analysis can be applied to other financial markets, such as forex and commodities, as long as there are price charts and technical indicators available for analysis.

- Are there any software tools available for identifying them?

- Yes, several software tools and trading platforms offer built-in indicators and scanners specifically designed to identify them in the market.

Divergences: Understanding in the Stock Market