Investing can be a powerful tool for building wealth and achieving financial goals. However, for beginners, navigating the complex world of investments can be overwhelming. In this article, we will discuss various investment strategies tailored specifically for beginners. Whether you’re just starting your investment journey or looking to expand your knowledge, these strategies will provide a solid foundation to make informed investment decisions and grow your wealth over time.

- Set Clear Financial Goals: Before diving into investments, it’s crucial to set clear financial goals. Identify what you want to achieve, such as saving for retirement, buying a home, or funding your children’s education. Defining your goals will help shape your investment strategy, timeframe, and risk tolerance.

- Start with an Emergency Fund: Before allocating funds to investments, establish an emergency fund. This safety net should cover three to six months’ worth of living expenses. Having readily available cash protects you from unforeseen circumstances and prevents the need to sell investments prematurely.

- Understand Risk Tolerance: Assessing your risk tolerance is vital for designing an investment strategy that aligns with your comfort level. Conservative investors may prefer low-risk investments, such as bonds or dividend-paying stocks, while those with a higher risk appetite may opt for growth stocks or venture into the cryptocurrency market.

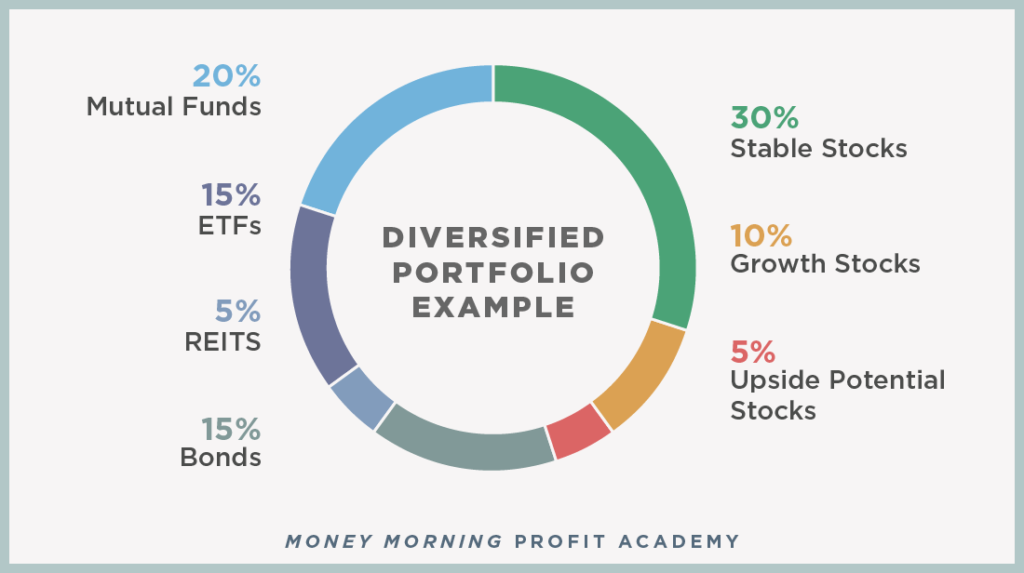

- Diversify Your Portfolio: Diversification is key to managing risk. Spread your investments across different asset classes, sectors, and geographic regions. By diversifying, you reduce the impact of any single investment’s performance on your overall portfolio. Consider investing in stocks, bonds, real estate, mutual funds, exchange-traded funds (ETFs), and other asset classes.

- Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount regularly, regardless of market conditions. By consistently investing over time, you buy more shares when prices are low and fewer when prices are high. This approach reduces the impact of short-term market volatility and allows you to benefit from the potential long-term growth of your investments.

- Take Advantage of Employer-Sponsored Retirement Accounts: If your employer offers a retirement account, such as a 401(k) or 403(b), take full advantage of it. These accounts often provide tax advantages and may offer employer matching contributions, which effectively boosts your savings. Contribute as much as you can afford, especially if your employer offers a matching program.

- Educate Yourself: Investing is a continuous learning process. Take the time to educate yourself about various investment options, market trends, and financial concepts. Read books, attend seminars, follow reputable financial websites, and consider working with a financial advisor to enhance your knowledge and make informed decisions.

- Regularly Review and Rebalance Your Portfolio: As your financial situation and goals evolve, periodically review your investment portfolio. Rebalancing involves adjusting your holdings to maintain your desired asset allocation. This process ensures that your portfolio remains aligned with your risk tolerance and investment objectives.

Investing for beginners may seem daunting at first, but by following these strategies, you can embark on a successful investment journey. Remember to set clear financial goals, diversify your portfolio, understand your risk tolerance, and educate yourself continuously. By starting early, staying disciplined, and adapting your strategy as needed, you can build long-term wealth and achieve your financial dreams. Seek guidance from professionals when necessary, and always remember that investing carries risks, so exercise caution and make decisions based on your individual circumstances. Happy investing!

мелбет kg http://mostbet10002.ru/ .