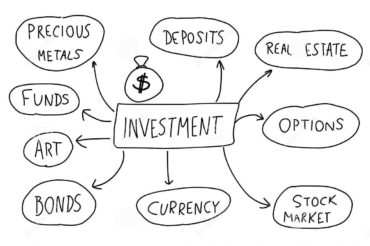

In the ever-evolving world of finance, identifying top investment opportunities is crucial for individuals seeking to maximize their financial growth. In this comprehensive guide, we will explore various lucrative avenues available in today’s market. Whether you’re a seasoned investor or new to the investment landscape, understanding these top investment opportunities can help you make informed decisions and capitalize on potential returns. From traditional investment options to emerging trends, this article will provide insights into promising sectors and assets that have the potential to generate substantial financial gains.

- Stock Market: Unleashing Growth Potential: The stock market remains a prime investment opportunity for individuals seeking long-term capital appreciation. Investing in well-established companies with strong fundamentals and growth prospects can offer significant returns. From blue-chip stocks to growth stocks and value stocks, carefully analyzing market trends and conducting thorough research can help identify companies poised for growth in sectors such as technology, healthcare, and renewable energy.

- Real Estate: Building Wealth Through Property: Real estate has long been considered a solid investment option for generating passive income and building long-term wealth. Opportunities abound in residential, commercial, and rental properties. Investing in real estate investment trusts (REITs) provides an avenue for diversification and access to professionally managed real estate assets. Additionally, crowdfunding platforms and real estate partnerships offer alternative ways to invest in properties with potentially lower capital requirements.

- Cryptocurrencies and Blockchain Technology: Embracing Digital Innovation: Cryptocurrencies, such as Bitcoin and Ethereum, and the underlying blockchain technology have gained significant attention in recent years. Investing in cryptocurrencies offers potential high returns but also carries higher risks. Diversifying a cryptocurrency portfolio and conducting thorough research can mitigate risks associated with this volatile market. Additionally, exploring investment opportunities in blockchain technology companies and platforms can provide exposure to the growing ecosystem.

- Bonds and Fixed-Income Securities: Balancing Risk and Returns: Bonds and fixed-income securities are attractive investment opportunities for individuals seeking a more conservative approach to investing. Government bonds, corporate bonds, and municipal bonds offer predictable income streams and can help diversify investment portfolios. Carefully assessing credit ratings, interest rates, and the overall economic climate is crucial when considering bond investments.

- Sustainable and Impact Investing: Aligning Profits with Purpose: Investors increasingly seek opportunities to make a positive impact while generating financial returns. Sustainable and impact investing focuses on supporting companies and projects that prioritize environmental, social, and governance (ESG) factors. Investing in renewable energy projects, socially responsible companies, or funds that prioritize ESG criteria can align financial goals with personal values.

- Emerging Markets: Tapping into Growth Opportunities: Investing in emerging markets presents opportunities for higher returns due to rapid economic growth and expanding consumer markets. Countries in Asia, Latin America, and Africa offer exciting investment prospects across various sectors, such as technology, infrastructure, and consumer goods. However, investing in emerging markets requires careful analysis of political stability, regulatory environments, and currency risks.

Exploring top investment opportunities is essential for individuals seeking financial growth and security. The investment landscape offers a myriad of options across stocks, real estate, cryptocurrencies, bonds, sustainable investing, and emerging markets. However, it is crucial to conduct thorough research, assess risk tolerance, and consider long-term goals before making investment decisions. Consulting with financial advisors and professionals in specific investment areas can provide valuable insights. By staying informed, diversifying portfolios, and adapting to market trends, investors can position themselves to seize lucrative opportunities and optimize their financial growth.