Continuation patterns are essential tools in technical analysis used by traders and investors to identify potential trends within the financial markets. These patterns indicate that an ongoing trend, whether bullish or bearish, is likely to continue after a temporary consolidation phase. By recognizing and understanding these patterns, traders can make informed decisions to capitalize on the market’s momentum and potentially generate profits. In this article, we will explore different types of continuation patterns, discuss how to identify them, and provide strategies for trading based on these patterns.

Table of contents

Types of Continuation Patterns

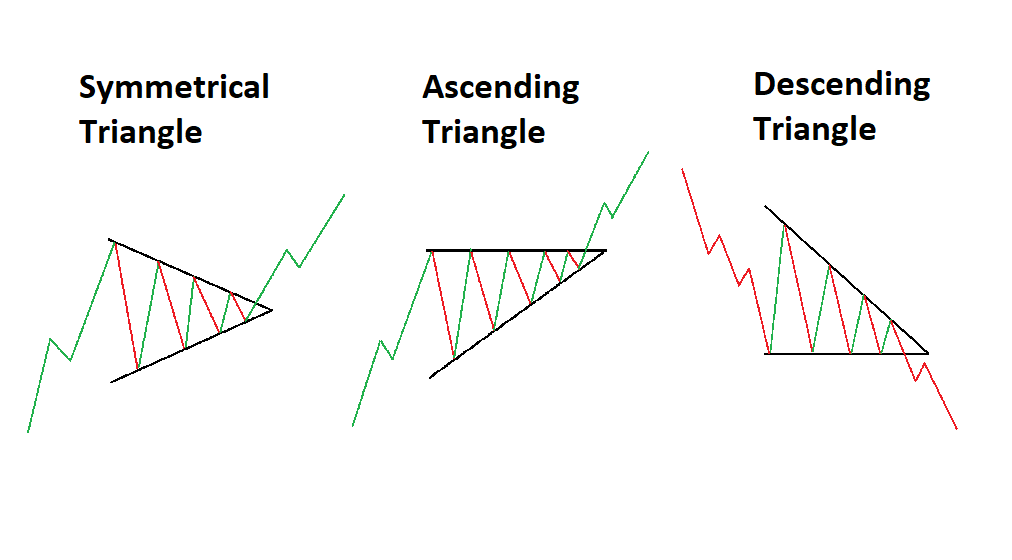

Symmetrical Triangle

The symmetrical triangle is a continuation pattern characterized by converging trend lines, forming a triangle shape. It represents a period of consolidation where the market’s highs and lows are gradually converging. Traders often interpret this pattern as a sign of indecision between buyers and sellers. Once the price breaks out of the triangle, it typically continues in the direction of the preceding trend.

Ascending Triangle

An ascending triangle is a bullish continuation pattern that forms when the market’s highs remain relatively flat, while the lows form an ascending trendline. This pattern suggests that buyers are becoming increasingly more aggressive, gradually pushing the price higher. When the price breaks above the upper trendline, it signals a potential continuation of the previous upward trend.

Descending Triangle

Contrary to the ascending triangle, the descending triangle is a bearish continuation pattern. It forms when the market’s lows remain relatively flat, while the highs form a descending trendline. This pattern suggests that sellers are gaining strength, gradually pushing the price lower. When the price breaks below the lower trendline, it indicates a potential continuation of the previous downward trend.

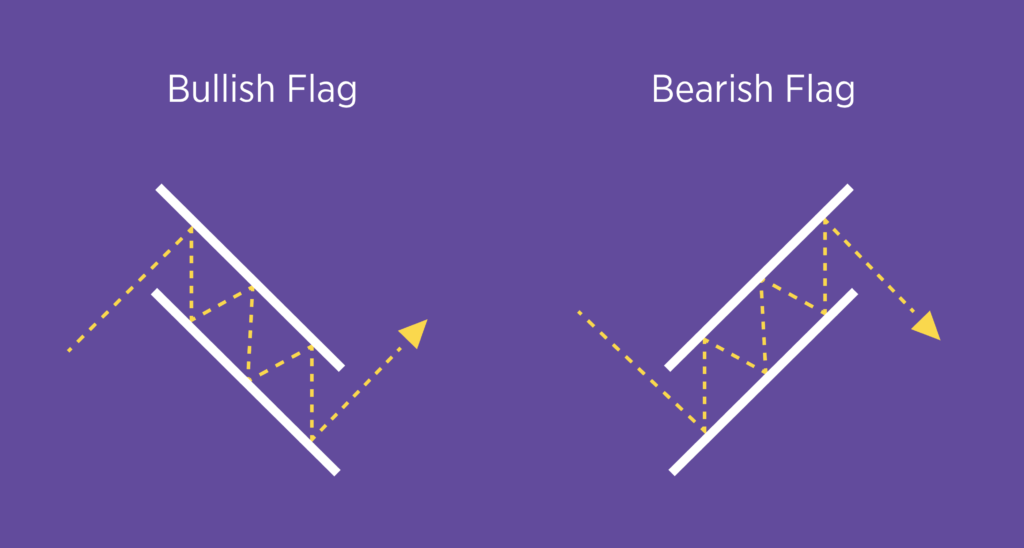

Bullish Flag

A bullish flag is a short-term continuation pattern that occurs within an uptrend. It consists of a sharp price rise, known as the flagpole, followed by a period of consolidation represented by a rectangular flag pattern. Traders often interpret this pattern as a temporary pause before the uptrend resumes. When the price breaks above the upper boundary of the flag, it signals a potential continuation of the previous upward trend.

Bearish Flag

Similar to the bullish flag, the bearish flag is a short-term continuation pattern that occurs within a downtrend. It consists of a sharp price decline, known as the flagpole, followed by a rectangular flag pattern representing a period of consolidation. Traders interpret this pattern as a temporary pause before the downtrend continues. When the price breaks below the lower boundary of the flag, it signals a potential continuation of the previous downward trend.

Bullish Pennant

The bullish pennant is a continuation pattern that resembles a small symmetrical triangle, often formed during an uptrend. It indicates a brief pause in the upward momentum before the trend resumes. Traders watch for a breakout above the upper boundary of the pennant as a potential signal for the continuation of the previous bullish trend.

Bearish Pennant

The bearish pennant is the opposite of the bullish pennant, forming during a downtrend. It represents a temporary consolidation before the downtrend continues. Traders monitor a breakout below the lower boundary of the pennant as a potential sign for the continuation of the previous bearish trend.

Rectangle

The rectangle, or trading range, is a continuation pattern where the price moves between parallel support and resistance levels. It signifies a period of consolidation and indecision in the market. Traders can anticipate a potential continuation of the previous trend when the price breaks out of the rectangle.

Wedge

A wedge is a continuation pattern characterized by converging trendlines that slant either upward (rising wedge) or downward (falling wedge). It represents a gradual reduction in price volatility and often precedes a strong breakout. Traders analyze the breakout direction to determine the potential continuation of the previous trend.

How to Identify Continuation Patterns

Identifying continuation patterns requires careful observation of price movements and chart patterns. Traders can use technical analysis tools, such as trendlines, support and resistance levels, and moving averages, to identify potential continuation patterns. Here are some key steps to follow:

- Determine the prevailing trend: Before identifying a continuation pattern, it is crucial to establish the existing trend, whether it’s bullish or bearish. This context provides a foundation for recognizing potential continuation patterns.

- Draw trendlines: Use trendlines to connect the highs and lows of price movements. Continuation patterns often emerge as converging trendlines or rectangular ranges.

- Confirm the pattern: Wait for the price to reach the point where the pattern is confirmed. This typically occurs when the price breaks out of the pattern, signaling a potential continuation of the previous trend.

- Validate with other indicators: Utilize additional technical indicators, such as volume, oscillators, or candlestick patterns, to confirm the validity of the them and gain further confidence in the potential trade setup.

Key Considerations for Trading Continuation Patterns

It is important to keep several key considerations in mind:

- Timeframe: Continuation patterns can appear on various timeframes, from short-term intraday charts to long-term weekly or monthly charts. Consider the timeframe that aligns with your trading strategy and goals.

- Confirmation: Wait for confirmation before entering a trade. A breakout or breakdown from the pattern’s boundaries validates the continuation pattern and provides a potential entry signal.

- Volume: Analyze trading volume during the pattern formation and breakout. Higher volume during the breakout strengthens the reliability of the continuation pattern.

- Risk management: Implement appropriate risk management techniques, such as setting stop-loss orders and determining position sizes, to protect your capital and manage potential losses.

Strategies for Trading Continuation Patterns

Here are a few common strategies employed by traders when trading continuation patterns:

- Breakout trading: Traders can enter a trade when the price breaks out above the upper boundary of a bullish continuation pattern or below the lower boundary of a bearish continuation pattern. This strategy aims to capture the continuation of the previous trend.

- Pullback trading: Alternatively, traders may wait for a pullback to the breakout level after the pattern’s confirmation. This strategy provides an opportunity to enter at a potentially more favorable price.

- Multiple timeframe analysis: Combine the analysis of continuation patterns across multiple timeframes to strengthen your trading decisions. Patterns appearing on higher timeframes carry more significance.

Common Mistakes to Avoid

While trading continuation patterns, it’s essential to be aware of common mistakes that traders often make:

- Failing to wait for confirmation: Entering a trade before the pattern is fully confirmed increases the risk of false breakouts and potential losses. Patience is crucial when waiting for confirmation signals.

- Neglecting other factors: Continuation patterns provide valuable insights, but they should not be the sole basis for trading decisions. Consider other technical indicators, market conditions, and fundamental factors to make informed choices.

- Overlooking risk management: Proper risk management is vital for long-term success. Failing to implement appropriate risk management techniques can lead to substantial losses.

They serve as valuable tools for traders to identify potential trend continuation opportunities. Understanding different types of continuation patterns, learning how to identify them, and employing appropriate trading strategies can enhance trading decisions and increase the likelihood of profitable trades. Remember to exercise caution, be patient, and always implement risk management practices when trading them.

FAQs

Q1. Can continuation patterns guarantee successful trades?

No, they do not guarantee successful trades. While they provide insights into potential trend continuations, other factors such as market conditions, fundamental analysis, and risk management must be considered for profitable trading.

Q2. How long do continuation patterns typically last?

The duration of them can vary significantly. Some patterns may form over a few days, while others may develop over several weeks or even months. The timeframe depends on the specific pattern and the market’s volatility.

Q3. Are continuation patterns applicable to all financial markets?

Yes, they can be observed in various financial markets, including stocks, forex, commodities, and cryptocurrencies. However, it is essential to adapt the analysis and strategies to the specific characteristics of each market.

Q4. Should I rely solely on technical analysis when trading continuation patterns?

While technical analysis is a valuable tool, it should not be the sole basis for trading decisions. Incorporate fundamental analysis, market sentiment, and other relevant factors to make well-rounded trading choices.

Q5. Can continuation patterns be used for both short-term and long-term trading?

Yes, they can be applied to both short-term and long-term trading strategies. Traders can adapt their analysis to different timeframes based on their trading goals and preferred holding periods.