Technical analysis plays a crucial role in helping traders identify potential market trends and make informed investment decisions. Among the many chart patterns used in technical analysis, the triple bottom reversal stands out as a powerful indicator of a potential trend reversal. In this article, we will explore the concept of a triple bottom reversal, its significance in trading, and how traders can utilize it effectively to enhance their trading strategies.

What is a Triple Bottom Reversal?

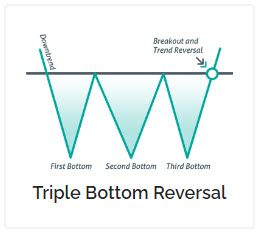

A triple bottom reversal is a bullish chart pattern that signifies a potential reversal in a downtrend. It forms when the price of an asset experiences three significant lows at approximately the same level, followed by a breakout above a resistance level. This pattern suggests that the selling pressure has weakened and the buyers are gaining control, indicating a potential trend reversal from bearish to bullish.

Understanding the Pattern

The triple bottom reversal pattern represents a battle between the bears (sellers) and the bulls (buyers). As the price reaches the same support level three times, it demonstrates that the bears are unable to push the price lower, and the bulls are stepping in to create buying pressure. The third low, followed by a breakout above the resistance level, confirms the reversal and signals a potential upward trend.

Identifying Triple Bottom Reversal

To identify a triple bottom reversal, traders should look for the following characteristics:

Three Lows

The pattern consists of three distinct lows that occur at or around the same price level. These lows should be spaced out over a period of time, indicating the price’s inability to break below a certain support level.

Resistance Level

A resistance level is formed by connecting the swing highs between the lows. The price should break above this resistance level after the formation of the third low, confirming the potential reversal.

Volume Analysis

Volume plays a crucial role in validating the pattern. Ideally, the volume should diminish as the price approaches the third low and increase during the breakout above the resistance level. This indicates a decrease in selling pressure and an increase in buying interest.

Confirmation of the Pattern

Confirmation of the triple bottom reversal pattern is essential before executing trades. Traders can use the following criteria to validate the pattern:

Breakout Confirmation

A breakout occurs when the price convincingly moves above the resistance level. Traders should look for a significant increase in volume during the breakout to confirm the pattern.

Retest

After the breakout, the price may retest the previous resistance level, which now acts as support. This retest provides traders with an opportunity to enter the trade with a favorable risk-to-reward ratio.

Trading Strategies for Triple Bottom Reversal

Traders can adopt various strategies when trading the triple bottom reversal pattern:

- Strategy 1: Breakout Entry: Traders can enter the trade immediately after the breakout above the resistance level, aiming to capture the upward momentum.

- Strategy 2: Retest Entry: Traders can wait for the price to retest the previous resistance level turned support before entering the trade. This strategy provides a better risk-to-reward ratio but may result in missing some trades.

Setting Stop-Loss and Take-Profit Levels

When trading this pattern, setting appropriate stop-loss and take-profit levels is crucial to manage risk and optimize returns. Traders should consider the following guidelines:

- Stop-Loss: Place the stop-loss below the lowest point of the triple bottom pattern or below the support level. This helps protect against unexpected price movements.

- Take-Profit: Identify potential resistance levels based on historical price data, Fibonacci levels, or other technical indicators. Take profits can be set near these levels to secure gains.

Managing Risk in Triple Bottom Reversal Trades

Risk management is a vital aspect of trading. Traders can employ the following risk management techniques when trading the triple bottom reversal pattern:

- Position Sizing: Determine the appropriate position size based on the risk appetite and account size. This ensures that potential losses are controlled.

- Diversification: Avoid concentrating all trades on a single asset. Diversifying the portfolio helps mitigate the risk associated with individual trades.

Triple Bottom Reversal Examples

Let’s examine a couple of examples to understand how the triple bottom reversal pattern appears on real charts:

[Include relevant charts and explanations]

Triple Bottom Reversal vs. Double Bottom

The triple bottom reversal pattern is often confused with the double bottom pattern. While both patterns indicate potential trend reversals, there are distinct differences:

[Highlight the differences between the two patterns]

Limitations and False Signals

Despite its effectiveness, the triple bottom reversal pattern is not foolproof. Traders should be aware of the limitations and potential false signals associated with the pattern:

[List some limitations and false signals]

The Importance of Volume in Triple Bottom Reversal

As mentioned earlier, volume analysis is crucial when identifying and confirming the triple bottom reversal pattern. Higher volume during the breakout strengthens the pattern’s validity. Traders should pay close attention to volume patterns to enhance their trading decisions.

Combining Triple Bottom Reversal with Other Indicators

Traders can enhance the accuracy of their triple bottom reversal trades by combining the pattern with other technical indicators, such as:

- Moving Averages

- Relative Strength Index (RSI)

- MACD (Moving Average Convergence Divergence)

Backtesting and Paper Trading

Before implementing the triple bottom reversal pattern in live trading, it is advisable to conduct backtesting and paper trading. Backtesting involves applying the pattern to historical data to assess its effectiveness. Paper trading allows traders to practice the pattern in a simulated trading environment without risking real money.

Psychological Aspects of Triple Bottom Reversal

Understanding the psychological aspects of trading is essential when using the triple bottom reversal pattern. Traders should manage emotions, practice discipline, and adhere to their trading plans to avoid making impulsive decisions based on short-term price fluctuations.

Wrap-Up

The triple bottom reversal pattern is a valuable tool for traders seeking trend reversal opportunities. By identifying this pattern and confirming it with appropriate analysis, traders can enhance their chances of capturing profitable trades. However, it is important to remember that no trading strategy guarantees success. Traders should exercise caution, implement risk management techniques

Sources