Welcome to our comprehensive guide on the double bottom chart pattern, an essential tool for technical analysis in the world of trading and investing. In this article, we will explore the intricacies of this pattern, its significance, and how you can leverage it to identify potential trade opportunities. Whether you are a seasoned trader or a beginner exploring the world of chart patterns, this guide will equip you with the knowledge and skills to make informed decisions in the market.

Understanding the Double Bottom Chart Pattern

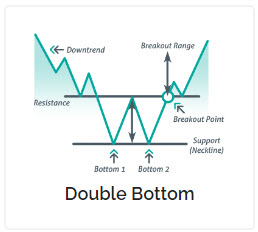

The double bottom chart pattern is a popular reversal pattern commonly found in financial markets, indicating a potential shift from a downtrend to an uptrend. It is characterized by two distinct troughs (or bottoms) forming at approximately the same price level, separated by a peak (or a short-term high) in between. The pattern resembles the letter “W,” with the middle peak serving as the neckline.

Identifying the Double Bottom Chart Pattern

To identify a double bottom chart pattern, traders need to observe certain key elements:

- Troughs: Look for two significant price troughs that are relatively equal in depth. The price level between the troughs is the middle peak or neckline.

- Volume: Typically, the trading volume is higher during the formation of the first trough and diminishes as the pattern progresses. However, the volume usually increases when the price breaks above the neckline, confirming the pattern’s validity.

- Duration: The time between the two troughs can vary, but it is generally advisable for the pattern to develop over a few weeks or months.

- Neckline Confirmation: The double bottom pattern is confirmed when the price breaks above the neckline, signaling a potential trend reversal.

Analyzing the Double Bottom Chart Pattern

Once the double bottom chart pattern is identified, traders can perform additional analysis to strengthen their trading decisions:

- Measuring the Pattern: Measure the distance from the trough to the neckline and project it upwards from the breakout point to estimate the potential price target.

- Volume Analysis: Observe the trading volume during the breakout. Higher volume suggests increased buying interest and provides additional confirmation.

- Support and Resistance Levels: Identify significant support and resistance levels near the pattern to determine potential obstacles or targets.

Trading Strategies

Trading the double bottom chart pattern requires a systematic approach and consideration of various factors. Here are some popular strategies to consider:

- Entry Strategy: Enter a long position when the price breaks above the neckline with substantial volume confirmation.

- Stop-Loss Placement: Set a stop-loss order slightly below the second trough to protect against potential downside risks.

- Price Target: Calculate the target price by measuring the distance from the trough to the neckline and projecting it upwards from the breakout point.

- Confirmation Indicators: Utilize additional technical indicators such as moving averages, oscillators, or trendlines to strengthen the confirmation of the pattern.

Common Mistakes to Avoid

While trading the double bottom chart pattern, it’s important to be aware of common mistakes that can hinder your success:

- Premature Entry: Avoid entering trades before the price breaks above the neckline, as this increases the risk of false signals.

- Neglecting Volume: Pay attention to volume confirmation during the breakout, as low volume can indicate weak buying interest.

- Ignoring Stop-Loss Orders: Always set a stop-loss order to protect against unexpected market movements.

- Overlooking Overall Market Conditions: Consider the broader market trend and sentiment before trading the pattern to increase the probability of success.

FAQs

What is the double bottom chart pattern?

This chart pattern is a technical analysis pattern characterized by two troughs separated by a peak, indicating a potential trend reversal from a downtrend to an uptrend.

How do I identify a double bottom chart pattern?

To identify this chart pattern, look for two significant troughs that are relatively equal in depth, separated by a peak. The price breaking above the neckline confirms the pattern.

What is the significance of the double bottom chart pattern?

This chart pattern signifies a potential trend reversal, offering traders an opportunity to enter long positions at favorable prices in anticipation of an uptrend.

Are there variations of the double bottom chart pattern?

Yes, variations of this chart pattern include the triple bottom pattern and the inverted head and shoulders pattern, each with its own unique characteristics.

Can the double bottom chart pattern be used in different markets?

Yes, this chart pattern can be observed in various financial markets, including stocks, forex, commodities, and cryptocurrencies.

What risk management strategies should I consider when trading the double bottom chart pattern?

When trading the double bottom chart pattern, it is essential to implement risk management strategies such as setting stop-loss orders, using proper position sizing, and considering the overall market conditions.

This chart pattern is a powerful tool in technical analysis, providing traders with valuable insights into potential trend reversals. By understanding how to identify, analyze, and trade this pattern effectively, you can enhance your trading strategies and unlock profitable opportunities in the market. Remember to always combine the pattern with other technical indicators and exercise proper risk management. Happy trading!

Sources