In the world of technical analysis, patterns play a crucial role in predicting price movements and identifying potential trading opportunities. One such pattern that has gained significant popularity among traders is the ascending triangle pattern. This article aims to delve into the intricacies of the ascending triangle pattern, exploring its definition, formation, trading strategies, and real-world examples. Whether you’re a seasoned trader or a novice investor, understanding this pattern can give you an edge in the market.

Table of contents

- What Is Ascending Triangle Pattern?

- Formation of Ascending Triangle Pattern

- Trading Strategies

- Real-World Examples

- FAQs

- FAQ 1: How is the ascending triangle pattern different from other chart patterns?

- FAQ 2: What are the key characteristics of an ascending triangle pattern?

- FAQ 3: What causes the price to break out of the ascending triangle pattern?

- FAQ 4: Are ascending triangle patterns reliable indicators for future price movements?

- FAQ 5: How can I identify an ascending triangle pattern on a price chart?

- FAQ 6: What risk management strategies should I employ when trading based on the ascending triangle pattern?

What Is Ascending Triangle Pattern?

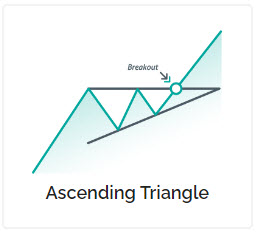

The ascending triangle pattern is a bullish continuation pattern that typically forms during an uptrend. It is characterized by a horizontal resistance line and an upward sloping support line, which converge to form a triangle-like shape. This pattern indicates that buyers are gradually becoming more aggressive, pushing the price higher while facing resistance at a particular level.

When the price reaches the resistance line multiple times without breaking it, and the swing lows get higher, it confirms the formation of an ascending triangle pattern. Traders interpret this as a sign of impending bullish momentum, suggesting that a breakout to the upside is likely to occur.

Formation of Ascending Triangle Pattern

The ascending triangle pattern is formed by the convergence of two trend lines—a horizontal resistance line and an ascending support line. The resistance line connects the swing highs, where the price encounters selling pressure, while the support line connects the higher swing lows, reflecting the increasing buying pressure.

The pattern takes shape as the price oscillates between these two lines, creating higher lows and maintaining a relatively stable resistance level. The longer the pattern develops, the stronger the potential breakout becomes. Traders often look for at least two touches on the resistance line and two or more higher swing lows to confirm the validity of the pattern.

Trading Strategies

Traders utilize the ascending triangle pattern to identify potential buying opportunities and plan their trades accordingly. Here are two common trading strategies that can be employed when encountering an ascending triangle pattern:

- Breakout Strategy: Traders wait for a confirmed breakout above the resistance line, accompanied by a surge in volume. This breakout signals a potential upward move, and traders enter long positions, expecting the price to continue its ascent. To mitigate false breakouts, it is advisable to wait for a candlestick to close above the resistance line before initiating a trade.

- Pullback Strategy: In some cases, the price may experience a pullback after the breakout, testing the newly formed resistance-turned-support level. Traders who missed the initial breakout can take advantage of this pullback to enter the trade at a potentially more favorable price. They place their stop-loss orders below the support level to protect against potential downside risks.

Real-World Examples

To further illustrate the application of the ascending triangle pattern, let’s examine a couple of real-world examples:

- Example 1: XYZ Company Stock: Suppose the stock price of XYZ Company has been gradually increasing over the past few months. Upon analyzing the price chart, you notice the formation of an ascending triangle pattern. The resistance line connects the previous swing highs, while the support line joins the higher swing lows. After several tests of the resistance line, accompanied by higher lows, the stock finally breaks out above the resistance with a surge in volume. This signals a potential bullish move, prompting traders to enter long positions.

- Example 2: Cryptocurrency Market: In the volatile world of cryptocurrencies, chart patterns can provide valuable insights. Imagine analyzing the price chart of a popular cryptocurrency and identifying an ascending triangle pattern. As the price approaches the resistance line multiple times and the swing lows consistently rise, traders anticipate a breakout to the upside. Upon confirmation of the breakout, traders might consider buying the cryptocurrency, expecting further price appreciation.

FAQs

FAQ 1: How is the ascending triangle pattern different from other chart patterns?

This pattern differs from other chart patterns in its unique structure. Unlike symmetrical triangles or descending triangles, the ascending triangle exhibits a horizontal resistance line and an upward sloping support line. This formation suggests a gradual increase in buying pressure and often precedes a bullish breakout.

FAQ 2: What are the key characteristics of an ascending triangle pattern?

The key characteristics of this pattern include a horizontal resistance line, an upward sloping support line, multiple touches on the resistance line, and higher swing lows. These elements collectively signify the potential for a bullish continuation.

FAQ 3: What causes the price to break out of the ascending triangle pattern?

The price breaks out of this pattern when the buying pressure becomes strong enough to overcome the selling pressure at the resistance level. This can be triggered by positive news, strong buying interest, or a significant shift in market sentiment.

FAQ 4: Are ascending triangle patterns reliable indicators for future price movements?

While these patterns can provide valuable insights into potential price movements, they are not foolproof indicators. Traders should consider other factors, such as overall market conditions, volume trends, and fundamental analysis, to make informed trading decisions.

FAQ 5: How can I identify an ascending triangle pattern on a price chart?

To identify this pattern on a price chart, look for a horizontal resistance line connecting multiple swing highs and an upward sloping support line connecting higher swing lows. The pattern should exhibit at least two touches on the resistance line and two or more higher swing lows.

FAQ 6: What risk management strategies should I employ when trading based on the ascending triangle pattern?

Risk management is crucial in trading. When trading based on this pattern, consider setting stop-loss orders below the support level to limit potential losses if the breakout fails. Additionally, ensure proper position sizing and avoid risking a significant portion of your trading capital on a single trade.

Wrap Up

This pattern is a powerful tool in technical analysis, providing traders with insights into potential bullish continuations. By understanding its formation, trading strategies, and real-world examples, traders can effectively incorporate this pattern into their trading arsenal. Remember, this pattern should be used in conjunction with other technical indicators and fundamental analysis for comprehensive decision-making.

So, next time you encounter this pattern in the market, carefully analyze its structure, confirm the breakout, and seize the opportunity for potentially profitable trades.